Fact Sheet: Minimum Account Requirements for Transit Riders

This memo summarizes barriers to getting banked in California, features of accessible banking, and highlights traditional and non-traditional banking products available to transit riders. These digital payment options are being highlighted by the California Integrated Travel Project (Cal-ITP) and/or transit providers as an option for customers who wish to pay using contactless options but do not currently have one.

Background

Cal-ITP supports transit agencies in modernizing their payment systems by facilitating the introduction of contactless open-loop payment acceptance, allowing riders to pay using contactless credit or debit cards and mobile wallets. While the majority of people have a contactless payment option, about 1 in 4 people in California are unbanked1 or underbanked2 and do not have a contactless payment option. These numbers disproportionately affect Native American, Black, Latinx, and Hispanic households, and cross income levels. Since many lower income individuals rely on transit to meet their daily mobility needs, finding solutions for these riders to take advantage of contactless payments on transit is a primary equity concern.

To ensure folks who wish to pay using contactless payments for transit have the opportunity to do so, Cal-ITP has worked to understand and build the market of digital payment options available to transit riders. This includes researching accounts for individuals who have difficulty accessing traditional bank accounts, and other alternatives such as fintech products and neobank3 offerings. The team is specifically looking for products that have low barriers to entry, provide a pathway to long term financial inclusion, and address some of the concerns shared by un- and underbanked people with having a bank account, such as lack of trust in banks.

Barriers to getting banked

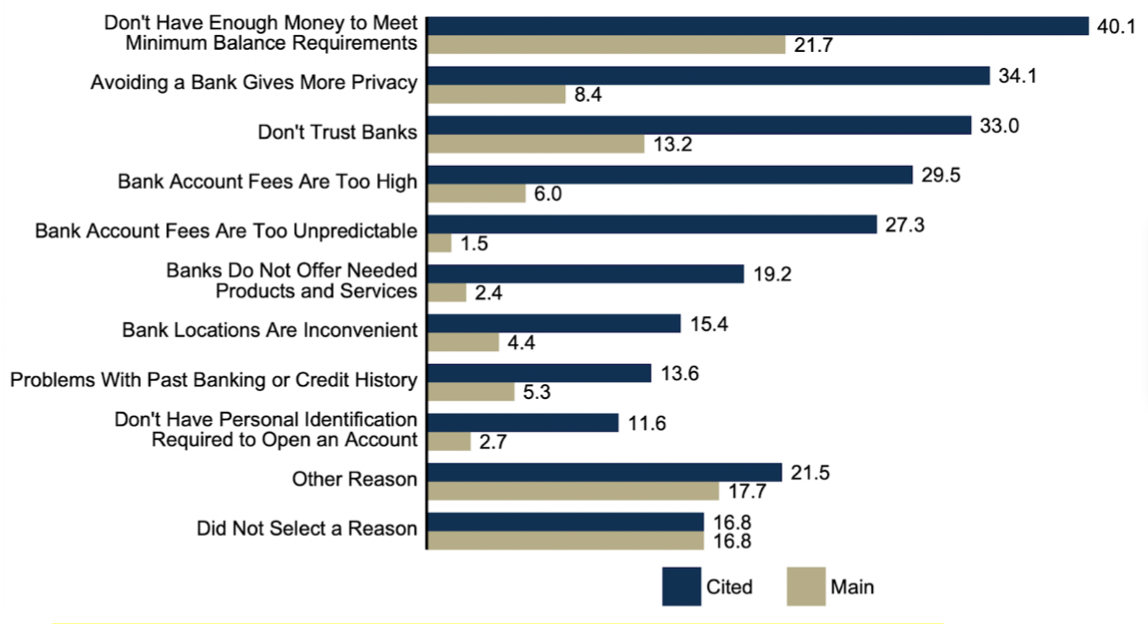

There are around 6 million unbanked and 18.5 million underbanked households in the United States (~4.5% and 14% respectively). In a biannual FDIC household survey4 on financial accessibility in the US, the three primary reasons people cited for not having a bank account are:

- High fees and minimum banking requirements: This is a deterrent for people who are capable of opening a bank account, but find the fees associated with either opening or maintaining one too high. This was the most cited reason for choosing to be unbanked.

- Lack of trust in banks: Some people do not trust banks due to previous experience or because they perceive them as untrustworthy.

- Privacy concerns associated with being banked.

Unbanked households’ Reasons for not Having a Bank Account, 2021 (%)4

Additionally, older FDIC surveys of un and underbanked households also cited bank locations as being a more prevalent issue. However, with the rise of online and neobanking offerings, this is becoming less of a barrier with time.

The cost of being unbanked

People who are unbanked or underbanked rely on cash for the majority of their daily payment needs, which comes with its own set of personal safety issues.

To meet some financial or digital payment needs, they sometimes resort to using alternative financial services, such as check cashing services, which provide easily accessible financial services, but at high cost. The fees of these services are typically higher than regular bank accounts and can cost individuals up to $930 a year5. Many of these services are conveniently located in areas where banking access is limited, making them a more pragmatic option for people within their vicinity or who only occasionally need to use them.

In addition to the increased financial cost, people who don’t have bank accounts or are not actively using them are unable to take advantage of the wider financial system. They will likely have low or no credit scores, which put them at a disadvantage when it comes to getting a loan or securing a line of credit for unexpected expenses.

Accessible banking trends

One of the primary reasons people choose to remain unbanked is a combination of minimum balance requirements and other fees associated with the maintenance of bank accounts. Today, banks are required to be more transparent with some of the fees they impose on their customers, whether it’s withdrawal fees, monthly maintenance fees, or other similar ongoing fees that previously weren’t well understood by customers. Additionally, banks are waiving many of these fees in some account offerings in an effort to increase the number of account holders.6

BankOn is an initiative by the Cities for Financial Empowerment Fund that supports efforts to connect consumers to safe and affordable bank accounts. It has developed model account standards for second chance and low-fee bank accounts. In return, banks who meet these standards can be certified as BankOn accounts. There are over 350 certified accounts available with 46,000 branches nationwide. When comparing the BankOn standards to the issues that are cited in the FDIC study, many of the fee-related issues that are cited as barriers to getting banked are addressed by either lowering them considerably or completely eliminating them. These standards provide a good entry point for people who are not banked and include requirements such as free remote account opening, acceptance of alternative forms of ID, and offer secured credit cards7 that allow people to build their credit safely.

In addition to traditional banking services, digital payments can also be facilitated by fintech alternatives such as Chime, Venmo, CashApp and Paypal. A fintech company is not necessarily a bank, but consists of combining modern technology and financial services. Many fintech firms—including marketplace lenders, virtual currency exchanges and providers of digital wallets—have turned to banks as partners to hold their deposits, buy their loans, or clear and settle the financial transactions they generated.8 Some fintechs are targeting the ‘credit-invisible’ market by offering people a chance to build credit and transact using contactless payments and mobile banking, sometimes without having to open a bank account. Various fintechs are offering products that have low barriers to entry that allow people to exchange their physical money to digital alternatives through retail networks. Some of them have also started issuing debit or credit cards to access these online accounts.

Efforts to get people banked have worked: 2021 had the lowest unbanked rate since the FDIC financial inclusion survey began in 2009. Many newly banked households at the time of the FDIC survey cited the disbursement of government benefits (eg: unemployment benefits or the COVID stimulus package) as a major reason they opened a bank account.

What makes a good account for transit riders

Recent developments in the digital payments landscape have the potential to directly benefit people who ride transit by providing an attractive financial option in lieu of cash. Cal-ITP is interested in increasing awareness and access to digital payment options, including bank accounts, to ensure that people have the medium to pay for their mobility needs and receive subsidized mobility benefits.

Features of a digital payment account that are important to transit riders (as well as other customers) are:

- Contactless EMV (cEMV) enabled on both physical cards and digital/mobile wallets to enable “tapping” on a transit fare reader.

- Low Know Your Customer (KYC)9 requirements so someone can quickly get onboarded and begin using the account to pay, including accepting alternative forms of identification to a Social Security Number, such as a California State Driver’s License or ID.

- Ability to add cash to the account at convenient locations with low fees (through physical branches, ATMs, or retail networks).

- Low minimum balance requirements and minimal or no fees associated with account maintenance.

- Low opening balance requirements.

- Web and mobile account management and banking services offered in multiple languages. Mobile banking is the fastest growing method of accessing bank accounts and conducting banking operations4 and lower income individuals are especially reliant on smartphones to conduct business.

- A variety of customer service options, such as availability online and by phone, offered in multiple languages.

- Accessible educational resources that equip account owners with the needed knowledge to manage their accounts and use them at the point of sale, so that account owners are able to deal with different situations that might arise, eg: rejected payments, lost cards, insufficient funds.

Cal-ITP Next Steps

Transit agencies in California have asked Cal-ITP for support in ensuring there are digital payment options for un- and underbanked transit riders. To date, the program has connected transit agencies with banks and fintechs to facilitate strategic partnerships, and raised awareness within the financial sector about transit. Looking ahead, Cal-ITP will continue to identify partnership opportunities with issuers and transit agencies to develop further learnings.

In addition, Cal-ITP will focus on enabling transit agencies and their riders to more easily leverage the products that are already available on the market with the following:

- Confirming the list of transit specifications that need to be added to the existing BankOn requirements. Cal-ITP will identify if there are any additional features or technical specifications beyond the existing BankOn minimum account requirements (including the list outlined in the section above) that are needed to ensure financial products will specifically meet the needs of and/or be beneficial to transit riders, for example requiring cEMV capability and offering transit rewards. Once identified, Cal-ITP will list account providers who are aligned with these requirements on Cal-ITP’s Mobility Marketplace website for transit agencies to refer riders to.

- Engaging with BankOn to highlight the transit use case. Cal-ITP will share learnings with BankOn coalition partners to build their understanding of the challenges and opportunities related to bank card usage in public transit. If possible, Cal-ITP will collaborate on identifying transit-suitable accounts and have BankOn coalition partners support Cal-ITP’s transit agency education and support efforts.

- Developing education packs (e.g. FAQ and “how to”) for transit agencies to highlight the opportunity to help riders access accounts that meet their needs. This will include (a) directing transit agencies to the list of suitable bank accounts either via BankOn’s website and/or via Cal-ITP’s Mobility Marketplace website, and (b) producing education materials that describe the transit-specific features and benefits that agencies and their customers should look for in an account.

Recommendations for Transit Agencies

When transit agencies begin accepting open-loop payments, un- and underbanked riders may want to learn about available options they can use to pay for their transit trip, but also for other daily purchases. As a trusted government service, transit agencies have a few options when it comes to partnerships with issuers.

At a minimum, transit agencies can point riders to the list of Cal-ITP issuers and/or local banks that have accounts that meet the minimum requirements through the BankOn initiative. These accounts are all FDIC insured and are specifically tailored towards un- and underbanked people. The transit agency would not need to have a contractual or financial relationship with any of these institutions, rather they would allow transit riders to choose an account provider that worked for them.

In addition, some transit agencies offer marketing and advertising opportunities, such as bus wraps, car cards, or bus shelter advertising. An agency could do proactive outreach to banks and issuers in their area to ensure they are aware the agency is accepting open loop payments and the opportunity to advertise their services to transit riders. An agency could choose to offer preferential pricing for advertisements related to digital payments if they would like to do so to increase awareness of the open-loop payment option among riders. This can be a mutually beneficial relationship where transit agencies are getting revenue through paid advertisements about digital payment options, while the issuer leverages the open-payment rollout to further increase adoption of their products.

Finally, agencies could go beyond referring riders and identify one or two banks or financial providers as preferred partners to advertise accounts to transit riders, ideally with transit rewards or benefits for riders. In this path, transit agencies should make sure that the bank is FDIC insured and its products can be used on transit.

Conclusion

Transit agencies in California have a mandate to serve everyone and an opportunity to increase awareness of financial products available to cash paying transit riders. This paper has identified opportunities for both the State of California and transit agencies to leverage industry offerings to improve equity and access through fare payments going forward.

In parallel to the areas of focus outlined in this paper, Cal-ITP continues its work in this space on several other important topics that will improve access and affordability for low-income and un-and underbanked travelers, including:

- Prepaid cards for government disbursements and mobility wallets,

- Credit building accounts for transit riders, and

- Automated linking of transit discounts to customers bank cards.

Please reach out to Cal-ITP at hello@calitp.org to find out more, or to discuss opportunities to partner in our work.

-

Unbanked refers to people who have no access to a checking or savings account with an FDIC insured institution. ↩

-

Underbanked refers to people who have a checking or savings account but regularly rely on alternative financial services such as money orders or payday loans. ↩

-

Neobanks provide digital-first services without brick-and-mortar locations as typically available with traditional banks. ↩

-

2021 FDIC National Survey of Underbanked and Unbanked Households ↩ ↩2 ↩3

-

Consumer Financial Protection Bureau. Data Insights Blog. February, 2023. ↩

-

A credit card where customers have to deposit money prior to using it; this type of product is often used as a tool to improve a customer’s credit score. ↩

-

Community Bank Access to Innovation Through Partnerships, 2021 ↩

-

Know your Customer (KYC) is a mandatory process that financial institutions must conduct to verify a potential customer’s identity. These requirements are influenced by international regulations put in place to combat money laundering and various illegal financing activities. Institutions that do not comply with KYC requirements are at risk of paying hefty fines, reputational damage, and potential prosecution. ↩